The regulatory landscape in the European Union (EU) has grown increasingly complex as the importance of cybersecurity and operational resilience takes centre stage, particularly in financial services. Two of the most significant regulations designed to protect critical sectors from cyber threats and operational disruptions are the Digital Operational Resilience Act (DORA) and the Network and Information Security Directive (NIS2).

In this blog, we will explore what DORA is, how it compares to other regulations like NIS2, the key requirements for compliance, and how a Managed Services Provider (MSP) can support financial institutions in their efforts to meet DORA’s requirements.

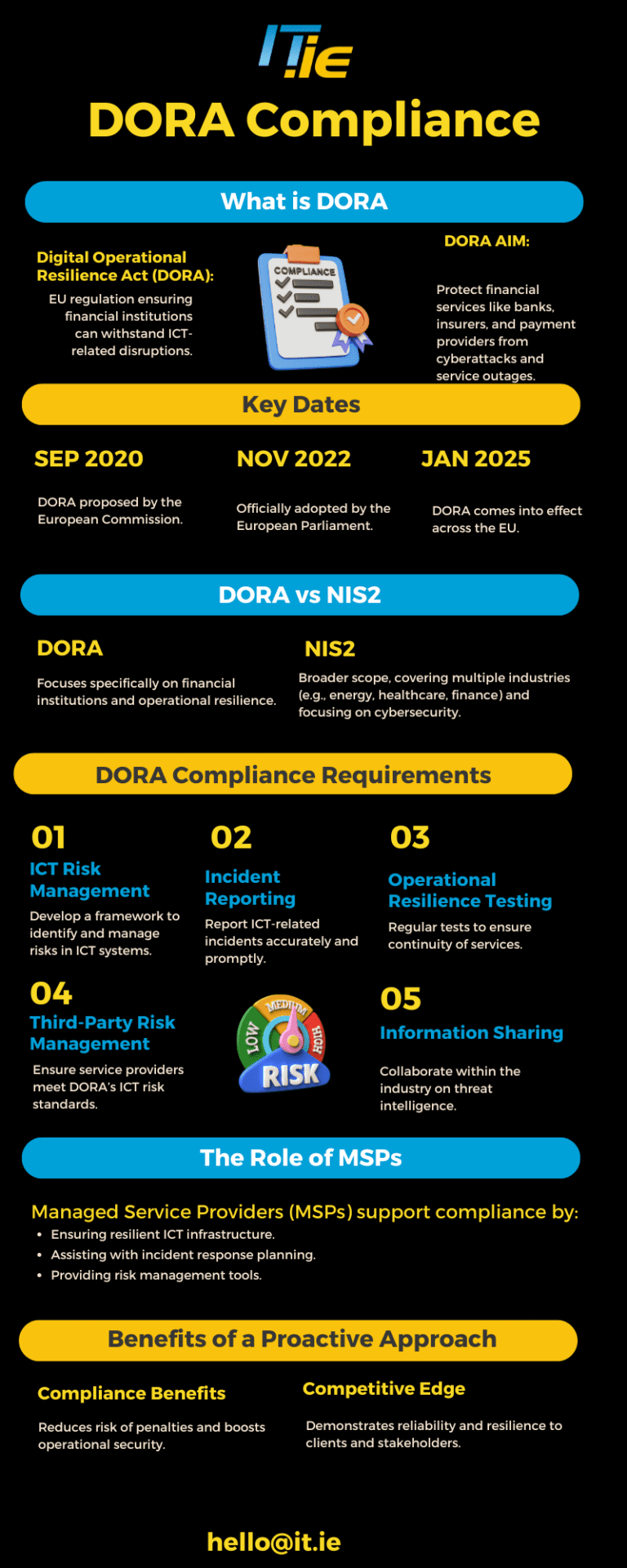

The Digital Operational Resilience Act (DORA) is part of the European Union’s larger financial regulatory framework. It aims to ensure that financial entities, such as banks, insurance companies, and payment service providers, are well-prepared to withstand ICT-related disruptions and cyberattacks. The act mandates that institutions implement robust measures to protect their ICT systems, ensuring continuity of services even during significant disruptions.

Key Dates:

DORA is designed to strengthen the operational resilience of financial services across the EU by setting clear guidelines on how firms should manage ICT risk, ensuring the stability of critical services during disruptions.

While DORA is focused specifically on the financial sector, the NIS2 Directive (Network and Information Security Directive 2) has a broader scope, covering essential services across multiple industries such as energy, transport, healthcare, and financial services.

Key Differences:

For financial institutions, it is essential to prioritise compliance with DORA due to its tailored focus on their industry.

DORA lays out specific requirements for financial institutions, aiming to enhance their ability to prevent, respond to, and recover from ICT-related incidents. The key requirements include:

DORA places a significant compliance burden on financial institutions, as they must ensure their ICT systems are secure, resilient, and capable of handling potential disruptions. This may require substantial changes to their current infrastructure and operational processes, particularly in terms of risk management and incident reporting.

Non-compliance with DORA can result in serious consequences, including fines and reputational damage. Therefore, it’s critical for financial institutions to take the necessary steps to ensure they meet the regulatory requirements.

An MSP can play a vital role in supporting financial institutions in their efforts to comply with DORA, particularly when it comes to maintaining ICT infrastructure and ensuring operational resilience. However, it is important to note that while an MSP can provide significant assistance, the responsibility for achieving compliance ultimately rests with the financial institution itself.

MSPs help by offering expertise in cybersecurity, incident response, and risk management. They can also support financial institutions in building and maintaining resilient ICT systems that align with DORA’s requirements.

Although MSPs are not responsible for ensuring compliance, they can provide critical services that support your institution’s efforts to meet DORA’s requirements:

One of the key advantages of partnering with an ISO 27001-certified MSP is the assurance that they follow internationally recognised best practices for information security management. This certification ensures that the MSP has a well-established framework for managing risks to information security, covering areas such as physical security, access control, and business continuity.

For financial institutions, working with an ISO 27001-certified MSP can significantly strengthen their compliance efforts, particularly in managing third-party risk and ensuring operational resilience. This is especially beneficial in regulated industries like finance, where data security and risk management are paramount. By choosing an ISO 27001-certified MSP, institutions can gain a higher level of confidence that their partners are adhering to the highest standards, which can support their overall compliance with DORA and other regulations such as GDPR and PSD2.

Taking a proactive approach to DORA compliance can offer significant advantages to financial institutions. By preparing early, you reduce the risk of non-compliance and ensure that your institution is well-equipped to handle ICT-related incidents.

In addition to regulatory compliance, demonstrating operational resilience can also provide a competitive edge, reassuring clients and stakeholders of your institution’s stability and reliability.

Challenges Financial Institutions May Face with DORA Compliance

Achieving compliance with DORA can be challenging, particularly for institutions with complex ICT infrastructures. Common challenges include:

MSPs can assist in addressing these challenges by helping institutions to develop streamlined processes for both incident reporting and risk management.

Cybersecurity threats are a growing concern for financial institutions, and addressing these risks is a core aspect of DORA compliance. MSPs can support financial institutions by providing managed endpoint detection and response (MDR) services, which help identify and respond to threats in real-time.

Additionally, MSPs will often partner with industry leading Security Operations Centres (SOC) that monitor for potential security breaches and respond to incidents quickly. These services align closely with DORA’s focus on operational resilience and can be invaluable in mitigating ICT risks.

As regulatory frameworks continue to evolve; financial institutions should be prepared for further changes in DORA and related regulations. MSPs can play a crucial role in helping institutions adapt to these evolving requirements, ensuring that their ICT infrastructure remains resilient and compliant.

In today’s dynamic digital world, financial institutions should view their MSPs as strategic partners in risk management providing the tools, expertise, and support necessary to build robust, resilient ICT systems.

DORA is an essential regulation for financial institutions operating in the EU, and its requirements can seem daunting. However, by partnering with a knowledgeable and experienced MSP, financial institutions can significantly improve their operational resilience, better manage ICT risks, and develop effective incident response strategies.

While the responsibility for compliance ultimately lies with your organisation, partnering with IT.ie can provide the expertise and solutions to help you strengthen your defences and achieve compliance with DORA or indeed NIS2. Get in touch with us at hello@it.ie to see how we can support your compliance journey.

We and our partners use cookies and process personal data (like unique IDs and Browse behaviour) to improve your experience, personalize content and ads, measure performance, and understand our audience.

You have the right to choose which cookies you'd like to enable. By clicking "Accept", you consent to all cookies. You can also "Reject" non-essential cookies, or manage your preferences through "View Preferences" below.

For more information on how we use cookies and your data, please read our Cookie Policy and Privacy Policy.

Fill in your details below and hit download.

Stay ahead of the curve with the latest in IT News, Offers, and Cyber Security advisories. Sign up for our mailing list today to keep your digital world secure and informed. Sign up now!