Invoice fraud continues to be a serious concern for businesses, leading to substantial financial losses and operational disruptions. Cybercriminals are becoming increasingly sophisticated, using deceptive tactics to manipulate companies into transferring funds to fraudulent accounts. This post explores the threat of invoice scams, real-world case studies, and strategies businesses can implement to protect themselves.

What is Invoice Redirect Fraud?

Invoice redirect fraud occurs when criminals impersonate legitimate suppliers or business contacts to trick companies into making payments to fraudulent accounts. This can be done via email, phone calls, or forged documents. By exploiting weak security measures and human error, scammers can siphon substantial sums before being detected.

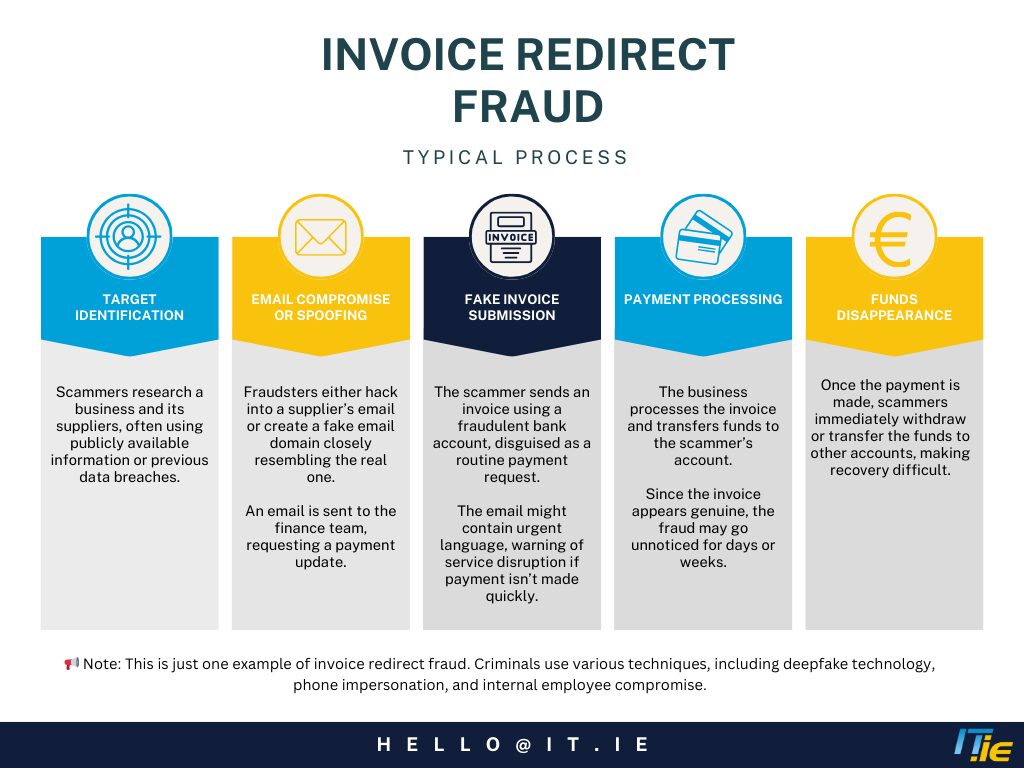

A Typical Invoice Redirect Fraud Process

Step 1: Target Identification

- Scammers research a business and its suppliers, often using publicly available information or previous data breaches.

Step 2: Email Compromise or Spoofing

- Fraudsters either hack into a supplier’s email or create a fake email domain closely resembling the real one.

- An email is sent to the finance team, requesting a payment update.

Step 3: Fake Invoice Submission

- The scammer sends an invoice using a fraudulent bank account, disguised as a routine payment request.

- The email might contain urgent language, warning of service disruption if payment isn’t made quickly.

Step 4: Payment Processing

- The business processes the invoice and transfers funds to the scammer’s account.

- Since the invoice appears genuine, the fraud may go unnoticed for days or weeks.

Step 5: Funds Disappearance

- Once the payment is made, scammers immediately withdraw or transfer the funds to other accounts, making recovery difficult.

Note: This is just one example of invoice redirect fraud. Criminals use various techniques, including deepfake technology, phone impersonation, and internal employee compromise.

The Rising Cost of Invoice Scams:

Key Statistics

- €10 Million Lost in 2023: Irish businesses lost over €10 million to invoice fraud in 2023, according to FraudSMART.. (Source:FraudSmart)

- Business Email Compromise Dominates Cyber Fraud: Business email compromise (BEC) scams, including invoice fraud, accounted for 70% of reported cyber fraud incidents. While 2023 figures are not explicitly detailed, the Banking & Payments Federation Ireland (BPFI) reported that Irish businesses lost €8 million in 2022 due to invoice fraud and CEO impersonation scams. (Source: Irish Examiner)

- Increase in Invoice Fraud Attempts: An Garda Síochána’s Garda National Economic Crime Bureau (GNECB) has warned of a significant rise in invoice fraud attempts, with reports suggesting a 40% increase since 2022. While specific GNECB statistics are limited, BPFI’s FraudSMART initiative reported a 25% increase in email-related fraud targeting SMEs in 2023. (Source: FraudSmart)

Real-World Examples

- Dublin Zoo Fraud 2018: In 2018, Dublin Zoo was defrauded of €500,000 through an internet-based scam where criminals manipulated banking details. (Source: Irish Times)

- International Scheme 2023: An international police investigation into invoice redirection fraud led to the conviction of two individuals in Ireland for laundering over €160,000. The fraudulent activities involved payments from accounts in Germany, Belgium, and Denmark. (Source: AML Intelligence)

- Cavan & Monaghan Businesses Targeted 2024: Gardaí have issued warnings after multiple businesses in Cavan and Monaghan were targeted by invoice redirection scams, where fraudsters tricked companies into sending payments to fraudulent bank accounts. (Source: Independent.ie)

How Scammers Target Businesses

Cybercriminals use various techniques to deceive businesses, including:

- Email compromise: Hackers gain access to company email accounts and send fraudulent invoices.

- Domain spoofing: Fake domains that closely resemble legitimate supplier websites.

- Social engineering: Manipulating employees into bypassing standard security checks.

- Fake invoice submissions: Fraudsters pose as genuine suppliers requesting payment to a new account.

Warning Signs of an Invoice Scam

- Urgent payment requests that deviate from normal procedures.

- Changes in bank details without official confirmation.

- Poor grammar and spelling in emails from supposed suppliers.

- Unusual invoicing patterns or unexpected billing from unfamiliar contacts.

The Role of Business Email Compromise (BEC) in Invoice Fraud

Business Email Compromise is a significant factor in invoice fraud. Criminals hack or spoof email addresses to impersonate trusted partners, making fraudulent invoices appear genuine. BEC scams have led to billions in losses globally and continue to rise in complexity.

Prevention Strategies for Businesses

Invoice fraud thrives on weak security measures and human error, making a multi-layered cybersecurity approach essential for reducing risk. Businesses should combine technical safeguards, employee awareness, and financial controls to protect against fraudulent transactions.

- Strengthen Authentication & Access Controls: Enforce multi-factor authentication (MFA) on all business email accounts to prevent unauthorised access. Restrict financial and sensitive data access to only essential personnel.

- Verify Payment Details & Strengthen Approval Processes: Always confirm bank detail changes with suppliers using a known phone number, not email. Implement dual authorisation for payments, ensuring no single individual can process large transactions.

- Enhance Employee Awareness: Human error is a leading cause of invoice fraud. Regular training and phishing simulations help employees recognise red flags such as urgent payment requests, subtle email spoofing, and unusual invoicing patterns.

- Use Secure & Verified Communication Channels: Move away from email-based invoice approvals and use secure invoicing platforms that require authentication. Encrypt sensitive financial transactions to prevent interception by cybercriminals.

- Proactive Cybersecurity Measures: Investing in email filtering and advanced threat detection helps block phishing attempts and business email compromise (BEC) scams. Regular security audits and system updates ensure businesses stay ahead of emerging threats.

A multi-layered defence like this significantly reduces the likelihood of falling victim to invoice fraud. For businesses looking for a comprehensive security solution, IT.ie’s CyberProtect provides enhanced protection by augmenting Microsoft 365 security with advanced threat prevention, identity protection, and continuous monitoring.

Legal and Financial Consequences of Invoice Fraud

Financial losses from invoice fraud can be severe and, in many cases, difficult to recover. Beyond direct financial damage, businesses can face regulatory scrutiny and reputational harm.

Regulatory Compliance and Penalties

Governments and regulatory bodies are increasingly tightening rules around financial fraud and cybersecurity. New regulations such as NIS2 (Network and Information Security Directive 2) and DORA (Digital Operational Resilience Act) are enforcing stricter security measures, particularly for businesses operating in sectors critical to financial stability and cybersecurity.

NIS2 Directive (Expected to be transposed into Irish law in 2025)

- Expands cybersecurity requirements for businesses handling sensitive digital transactions.

- Increases penalties for non-compliance, with fines of up to €10 million or 2% of global turnover.

- Introduces stricter incident reporting obligations for cyber fraud cases, including invoice scams.

DORA (Digital Operational Resilience Act)

- Specifically targets financial institutions and their third-party service providers.

- Requires robust risk management frameworks to protect against cyber threats, including fraudulent transactions.

- Mandates stress testing to assess resilience against cyber fraud attempts.

Failure to comply with these regulations could lead to significant penalties and reputational damage. Businesses must proactively adopt stronger cybersecurity measures to avoid financial and legal risks.

Unlike NIS2, DORA has direct effect and does not need to be transposed into Irish law and came into effect on the 17th of January 2025.

Steps to Take If Your Business Falls Victim to an Invoice Scam

- Contact your bank immediately to attempt to reverse the transaction.

- Report the fraud to An Garda Síochána and your bank.

- Inform affected suppliers and partners to prevent further fraud attempts.

- Strengthen internal security measures to prevent future incidents.

Best Practices for Secure Vendor Communication

- Verify invoice changes via phone using previously known contact details.

- Use encrypted communication channels for sensitive financial transactions.

- Establish clear payment approval procedures with multiple sign-offs.

- Train staff regularly on fraud prevention and secure practices.

Emerging Trends in Invoice Fraud and Future Risks

- AI-driven fraud: Scammers using artificial intelligence to automate invoice scams.

- Deepfake technology: Fraudsters replicating voices or emails of executives.

- Increased targeting of SMEs: Smaller businesses remain a prime target due to weaker security measures.

- Rise in cross-border fraud: International scams making detection and recovery harder.

Conclusions

Invoice scams are a significant threat to businesses, but with the right precautions, you can protect your company from falling victim. Implementing robust verification processes, educating your team on recognising fraudulent activities, and staying vigilant are key steps in safeguarding your finances. Remember, it’s crucial to verify any unexpected or unusual payment requests, even if they appear to come from trusted sources. Taking a moment to double-check can prevent substantial financial losses.

At IT.ie, we understand the challenges businesses face in today’s digital landscape. Our team is dedicated to providing comprehensive support and guidance to help you navigate these threats effectively. If you have any concerns or need assistance in strengthening your company’s defences against invoice scams, don’t hesitate to reach out to us at hello@it.ie. We’re here to help you stay secure and ensure your business thrives without the worry of cyber threats.